Required role: Finance

In Raley PO as a user with Finance role you can setup taxes which will be later applicable to your products and purchase requests/orders. Initially, after the installation of the app there are no taxes set, so you need to do that first.

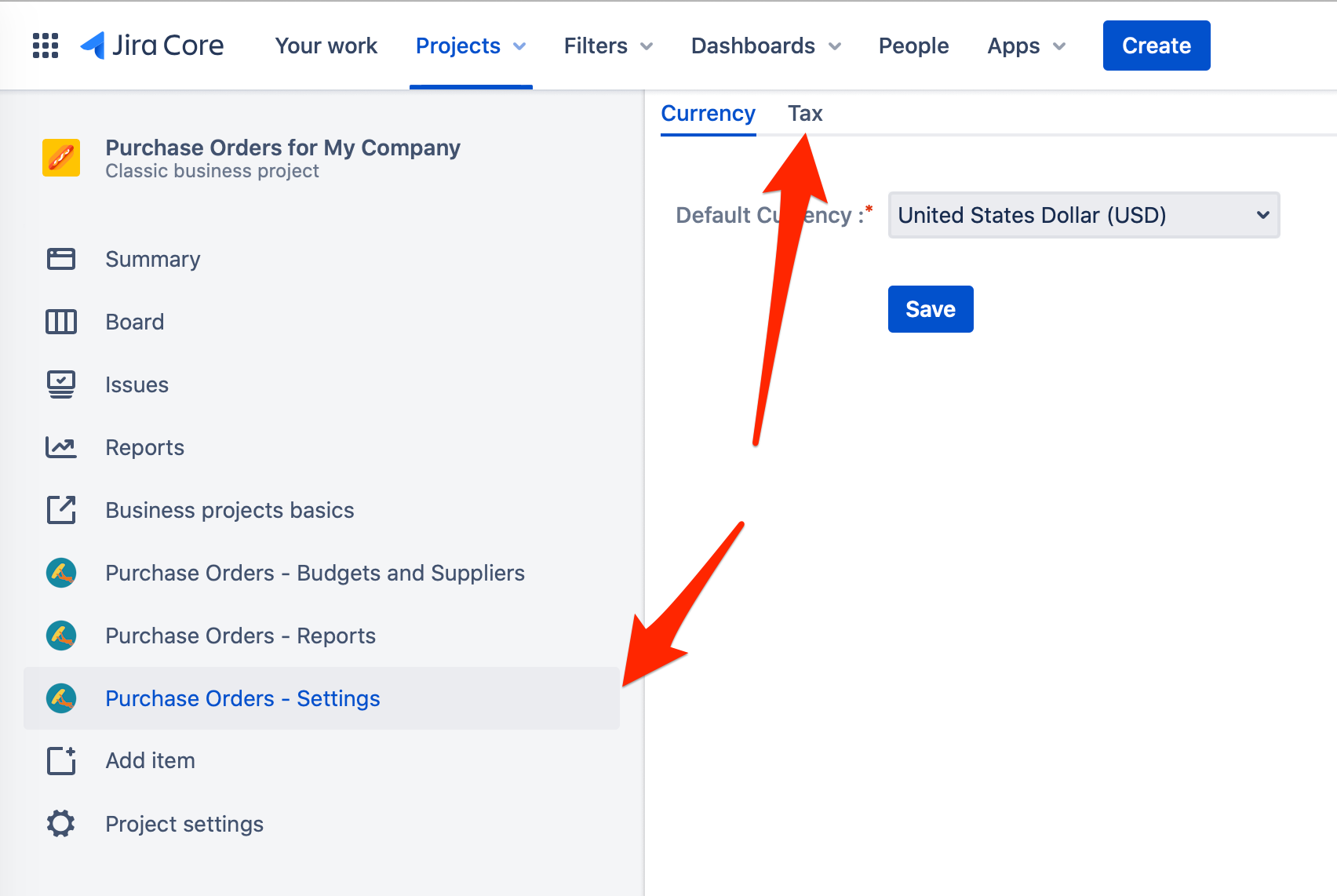

1) Click on Projects → View All Projects and then click on the project name that is configured as your PO project. In the left project panel click on "Purchase Orders - Settings" and then click on tab "Tax" as shown on the screenshot below:

2) You'll be presented with a screen for managing Taxes in Raley PO. Click on "Add new Tax" button and provide values related to your tax.

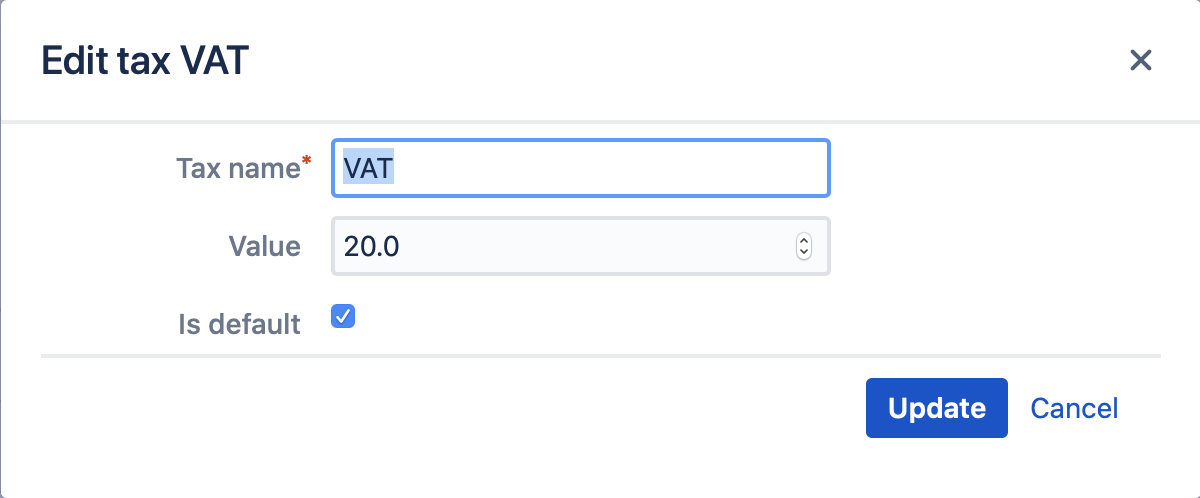

In the screenshot below you can see an example of VAT tax configuration:

In this case, the configured tax rate is 20% and it is applicable by default. In your taxes configuration there must be exactly one tax that is a default tax.

The default tax will apply when:

- Importing products from a CSV file

- Creating new products manually via Purchase Orders - Budget and Suppliers → Suppliers → Products

- Creating new products on the fly when adding new Purchase Order Lines